The biodiversity-related role of the financial sector requires an integrated approach with climate

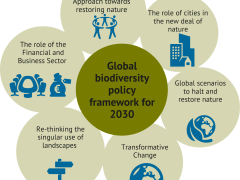

In their report ‘From Paris to Kunming - Enabling a carbon net zero and nature-positive financial sector’, the Sustainable Finance Lab, Utrecht University, at the request of PBL Netherlands Environmental Assessment Agency, analysed the impact of the financial sector on biodiversity, how the related risks could be mitigated and opportunities seized. The report discusses what the financial sector and government authorities could do to enable the financial sector to play an effective role in achieving both climate and biodiversity targets. It especially draws lessons from and builds on the way the climate change issue is starting to get mainstreamed in the financial sector. The report contributes to the preparations for a new global biodiversity governance framework, to be agreed under the umbrella of the UN Convention on Biological Diversity (CBD), later this year. The report provides specific recommendations for both the financial sector and public-sector decision-makers.

The financial sector will not be shielded from the risks of biodiversity loss and climate change

These topics therefore need to be on the radar of every financial risk manager and supervisor. It is however not only about reducing risks, but also about opportunities. The energy transition and restoring biodiversity offer financial opportunities and align with the mission to achieve a positive impact by public financial institutions, including central banks, and an increasing number of private financial institutions.

The financial sector has potent instruments at its disposal to effectively reduce the risks related to biodiversity and climate change and seize the associated opportunities

Although the awareness of biodiversity risks is increasingly entering the financial agenda, the impact on the ground, so far, has been limited. The challenge ahead is for the severity and urgency of biodiversity and climate problems to be met with an appropriate and effective reaction from the financial sector.

The financial sector cannot afford to wait with taking action until biodiversity and climate are fully integrated into current financial models and tools

There may never be a complete integration of these issues in the financial sector due to the multi-facetted dimensions of both biodiversity and climate change and the fundamental uncertainty about biodiversity and climate effects. Financial supervisors like central banks have been studying and modelling climate change for over seven years now. However, despite climate change having been labelled as a driver of material risk, this has been without consequence regarding the capital requirements for banks within Europe. Biodiversity loss, too, is now widely recognised as a material financial risk; however, it is not being managed as such.

The next few years will be decisive in ensuring that society does not cross any critical, irreversible, thresholds

It is for this reason that the financial sector and its supervisors should follow the precautionary principle and start to act, accepting that it is better to be roughly right than to be exactly wrong. In recent years, there have been many European regulations to increase data availability and transparency. So far, these have mainly focused on climate-change-related data. For example France has shown that it is possible to broaden the scope to include biodiversity.

Public budgets are market-making and, currently, do not effectively help to preserve biodiversity or halt climate change

The objective of the 2010 biodiversity framework to double the spending on preservation has not been met — in fact, each year, over USD 500 billion in public spending is actually harming biodiversity. In 2019, the Coalition of Finance Ministers for Climate Action was formed to promote climate action through the use of public finance and fiscal policy. However, climate-negative subsidies are still of the same order of magnitude as those negatively impacting biodiversity. Public investment institutions play an important role in driving the energy transition. However, so far, biodiversity has not been high on the agenda of both nationally and internationally operating public investment institutions.

Although supervisors have started to consider climate change, they have not yet taken any action, and the situation is arguably worse for biodiversity

The ECB recently concluded that virtually all banks still have a blind spot for biodiversity risks. Outside of the eurozone, however, we do see that supervisors already link environmental risk performance to capital requirements, effectively providing an incentive for financial institutions to become involved in more nature-positive financing. Academics and civil society organisations also argue in favour of this, and, more specifically, for supervisors to adopt the precautionary principle and act now.

Monetary policy is starting to take climate change into account, but still needs to move on biodiversity

The ECB is expected to integrate climate risks into its collateral framework for this year. Other central banks have already done so and have also adjusted their purchasing programmes. For biodiversity, there have been no such actions and none are planned.